-

City Hall

-

- Common Council Meet Your Council Meeting Information Boards & Commissions Agendas and Minutes Vacancies City Manager City Staff Departments Administration City Assessor City Clerk Elections Finance Airport Community Development Housing Authority

- Departments Communications Fire New Fire Facility Project Library Museums PATH Parks & Recreation Mound View Campground Event Center Parks Recreation Senior Center Police Public Works City Cemeteries Water & Sewer City Staff Directory

-

Budgets

Municipal Code

Job Opportunities

Bids and RFPs

Platteville Places (GIS)

Forms, Permits and Applications

Documents, Reports,

and Presentations Parking Elections

-

-

Business & Development

-

-

Bring Your Business

Here Municipal Code Platteville Transit Platteville Airport New Development Comprehensive Plan Development and Zoning Application Fees Current Projects New Housing Fee Report - Downtown Downtown Revitalization Plan Historic Preservation Plan Downtown Reserved Parking Main Street Redevelopment Authority TIF Districts Forms, Permits and Applications Bids and RFPs

- Economic Development Partners Platteville Regional Chamber Platteville Business Incubator Platteville Area Industrial Development (PAIDC) Grant County WI Economic Development (GCEDC) Wisconsin Small Business Center Wisconsin Women's Business Initiative Wisconsin Economic Development Corp. (WEDC)

-

Bring Your Business

-

-

Our Community

-

- Welcome to Platteville Life in Platteville New Residents Community Kudos Demographics History Local Businesses Things to Do Upcoming Events Farmer's Market Library Museums Parks & Recreation Pool Senior Center Tourism Biking & Hiking ATV/UTV Routes

- Services Services A-Z Elections & Voting Broske Event Center Rentals Auditorium Rental Garbage & Recycling Parking Information Dog Licensing Platteville Places (GIS) Public Transportation Submit a Request or Concern Yard Waste Public Safety Police Fire COVID-19 (Coronavirus) Parking

- Community Organizations Platteville Regional Chamber Main Street Program Platteville Community Arboretum Rountree Gallery Current Projects Schools Platteville School District University of Wisconsin-Platteville Southwest Tech

-

-

Connect

-

- Contact Us Submit a Request or Concern Submit a Community Event City Staff Directory Department Contacts Job Opportunities Alerts and Notifications Email Subscriptions CodeRED Alerts New Residents

- Online Resources Agendas and Minutes Calendar Municipal Code Documents, Reports, and Presentations Forms, Permits, and Applications City News In The Spotlight 53818 Update Newsletter

- Social Media Facebook City Library Museum Parks and Recreation Police Pool Senior Center Twitter City Library Police

-

Assessment Process

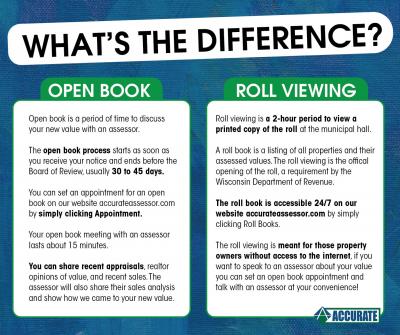

The assessment process in Wisconsin is regulated by the WI Department of Revenue (DOR). State law requires that assessors are certified by the DOR. Certification involves an exam that tests their knowledge of appraisal and assessment law and administration. Assessors are also required to follow an assessment manual which is issued by the DOR.

Wisconsin has an annual assessment. This means that each year’s assessment is a new assessment. The assessor may change your assessment because of building permits or sales activity even if the assessor did not inspect your property.

Under state law (sec 70.05(5), Wis. Stats.), each municipality must assess major classes of property within 10 percent of full value in the same year, at least once within a five-year period. If a City does not comply after six years, the State will conduct a supervised assessment. The reports of compliance for all municipalities, by county, can be found here: https://www.revenue.wi.gov/Pages/EQU/mclass-home.aspx.

In 2018, the City underwent a Full Revaluation to bring assessed values into compliance after the Commercial property class was out of compliance for four years. As a result, all property classes were in compliance for 2018 and 2019. However, in 2020 and 2021 the Commercial class dropped out of compliance, at less than 90% of full value as determined by the DOR. According to City Assessor Accurate Appraisal, this is because of volatility in property values over the past couple of years. Accurate reports seeing ratios in some municipalities change more than 12% in one year! In 2022, Accurate will perform an Interim Market Update which will bring property class values back into compliance.

An Interim Market Update is a type of revaluation, but does not involve physical inspection of every property. Just as in a regular Maintenance year, the assessor may inspect properties which changed hands or filed a building permit. During an Interim Market Update the assessor will look at the assessed value of all properties in the City and will use statistical data, sales data and any other information that may impact values to determine if the assessed value needs to be adjusted. Information requested by the assessor is required to be kept confidential, in accordance with Section 70.47 of the Wisconsin State Statutes.

More information is available in the 2024 Guide for Property Owners on this page.